Credit domain and loan management application

See how Opcito designed and developed a credit domain and loan management application

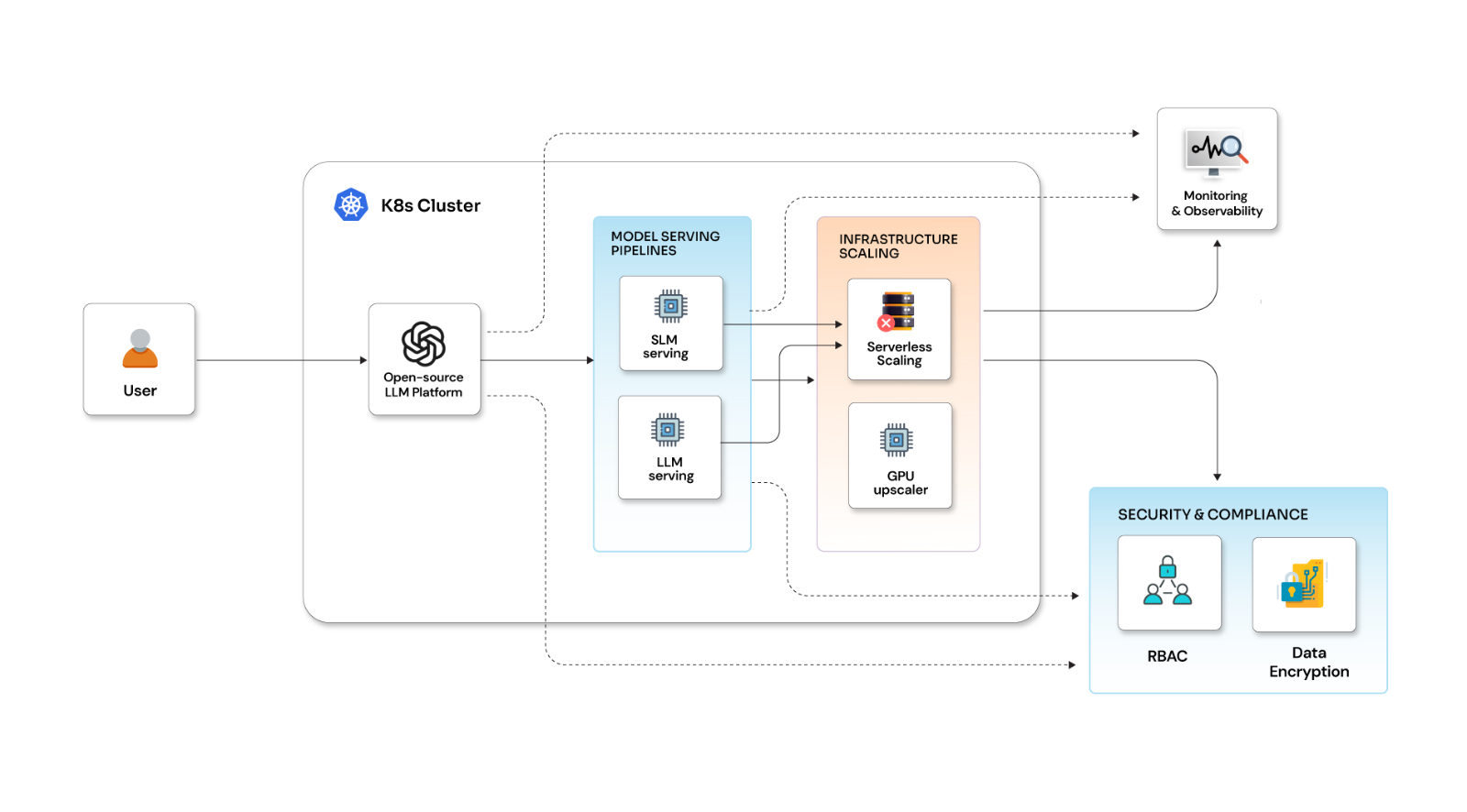

The customer is a leading NBFC in India and needed help to revamp its credit platform. The customer approached Opcito with significant challenges around processing time, automation, and a centralized system. After carefully considering all the business operations, process dependencies, and automation possibilities, Opcito's team of architects designed and developed an entire credit domain application that could handle different credit requests with minimal human intervention. The solution involved five vital components a central control, a journey manager, RBAC, a centralized logging portal, and a log portal. The credit domain application was integrated with other portals and approval processes in the periphery to make these services available to other teams involved.

Technologies

- Front-end: Angular

- Back-end: Java Spring Boot

- Automation testing: Selenium & Cucumber

- Infrastructure: AWS cloud

Benefits

- Reduced loan application processing time by 77%

- High availability with guaranteed performance and uptime

- A unified view for increased operational and monitoring efficiency.